Request Letter to Bank for Cancellation/ Closing of Credit Card

It is straightforward to cancel or close your credit card. All you need to do is write a letter to the bank requesting the cancellation of your credit card. In the letter, you should mention your credit card number and state why you want to cancel or close your credit card account.

The main reason people cancel their credit cards is that they are not happy with the charges levied on them. They may also be dissatisfied with how a dispute relating to a credit card transaction was concluded. Whatever the reason, it is essential to mention it in the letter so that the bank can take note of it and improve its services.

Similar post: Request Letter To Bank For Cash Credit Limit

Credit Card Close Application: A Comprehensive Guide to Streamline the Process

In today’s fast-paced digital era, credit cards have become integral to our financial lives. These plastic wonders offer convenience, flexibility, and numerous benefits that cater to various financial needs. However, there may come a time when you need to close a credit card account. Understanding the credit card close application process is crucial, whether it’s due to changing economic circumstances, consolidating your credit accounts, or simply wanting to minimize your financial obligations.

At [Your Company Name], we understand the importance of providing accurate and comprehensive information to empower individuals like you. In this article, we will guide you through the credit card close application process, step by step, to ensure a seamless experience. So, let’s dive in!

Assess Your Financial Situation

Before initiating the credit card close application, take a moment to evaluate your overall financial standing. Determine your reasons for closing the credit card account and consider the potential impact on your credit score, outstanding balances, and future creditworthiness. This self-reflection will help you make an informed decision and navigate the process effectively.

2. Review the Terms and Conditions

Every credit card issuer has specific terms and conditions for closing an account. Reviewing these guidelines to understand any potential fees, outstanding balances, or documentation required during the credit card close application process is crucial. Familiarize yourself with the terms and conditions to avoid any surprises along the way.

3. Pay off Outstanding Balances

Ensure that all outstanding balances on your credit card are settled before proceeding with the credit card close application. This helps you avoid accumulating additional interest charges, strengthens your financial standing, and simplifies the closure process.

4. Contact the Credit Card Issuer

Once you have completed the necessary preparations, it’s time to contact the credit card issuer. You can find the customer service contact information on the back of your credit card, the issuer’s website, or your monthly statements. Contact the issuer’s customer service department and inform them about your intention to close the credit card account.

5. Provide Necessary Information

During your conversation with the customer service representative, be prepared to provide specific details, such as your account number, personal identification information, and the reason for closing the credit card account. This information will facilitate the credit card close application process and ensure a smoother transition.

6. Follow the Issuer’s Instructions

Each credit card issuer may have a slightly different process for closing an account. It is essential to carefully follow the instructions provided by the customer service representative. They may ask you to submit a written request or confirm your request over the phone. Pay close attention to the issuer’s guidelines to ensure everything runs smoothly and smoothly.

7. Obtain Confirmation

Once you have completed the credit card close application process, request written confirmation from the credit card issuer. This confirmation should include details of the account closure, such as the closure date and any remaining balances or pending transactions. Keep this confirmation in your records for future reference.

8. Monitor Your Credit Report

After closing your credit card account, it is crucial to monitor your credit report to ensure that the account closure is accurately reflected. Regularly reviewing your credit report allows you to identify discrepancies or errors promptly. You can obtain a free copy of your credit report from various credit bureaus once a year.

Closing a credit card account may seem daunting, but with the proper knowledge and preparation, it can be a straightforward process. At [Your Company Name], we believe in empowering individuals by providing them with the tools and information they need to make informed financial decisions.

Remember, if you have any questions or concerns during the credit card close application process, don’t hesitate to reach out to our team of financial experts. We are here to assist you every step of the way and ensure that your credit card close application is handled with utmost care.

In addition to the step-by-step guide we have provided, here are a few additional tips to make your credit card close application even more effective:

1. Communicate: When contacting the credit card issuer, clearly express your intention to close the account. Be concise and provide all the necessary information to avoid any confusion or delays in the process.

2. Be Aware of Potential Fees: Some credit card issuers may charge a fee for closing an account. Familiarize yourself with the terms and conditions to understand if any fees apply and factor them into your decision-making process.

3. Consider Alternative Options: Before closing a credit card account, explore options that suit your needs better. For example, if high-interest rates are a concern, you may inquire about a lower interest rate or explore balance transfer options to another credit card.

4. Impact on Credit Score: Closing a credit card account can affect your credit score. Consider the impact this may have before proceeding with the closure. If maintaining a healthy credit score is a priority, keep the account open, even if you no longer actively use it.

5. Secure Your Finances: Before closing a credit card account, ensure you have alternative payment methods. Having a backup plan will prevent any inconvenience during the transition period, whether it’s another credit card, debit card, or cash.

Similar post: Request Letter To Bank For Cash Credit Limit

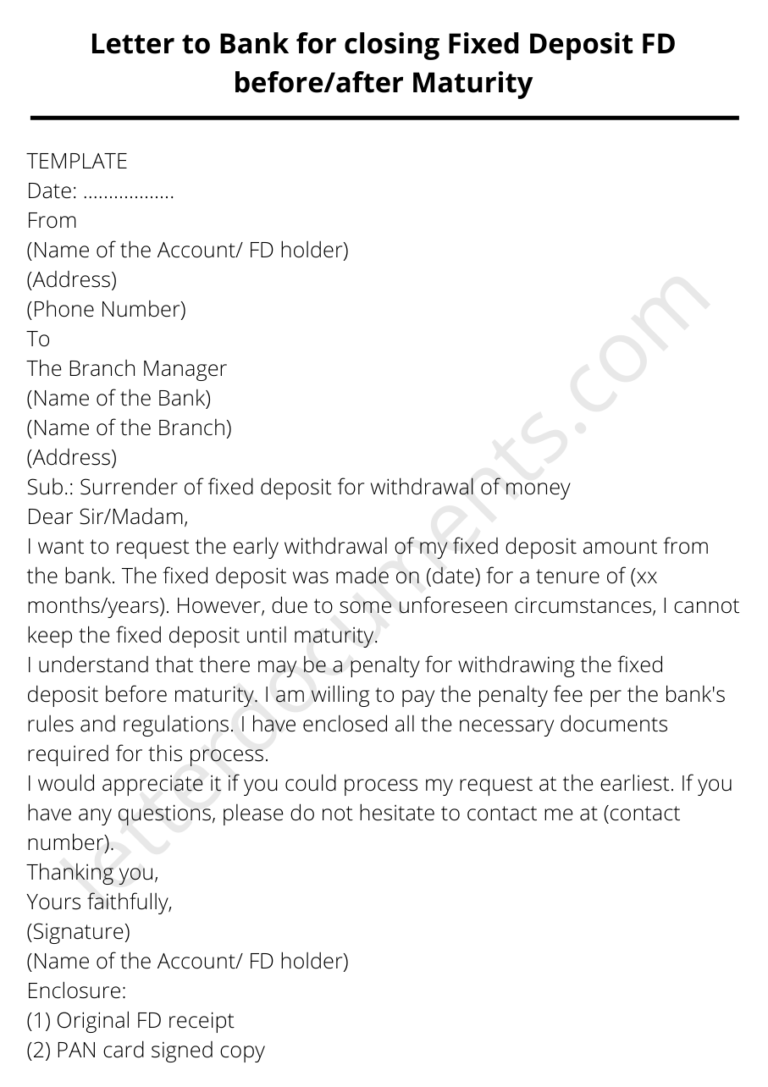

Here is a sample of such a letter for your reference.

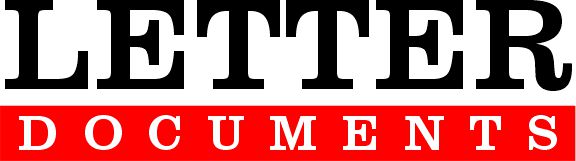

TEMPLATE

Date: ……………..

To

The Branch Manager

(Name of the Bank)

(Name of the Branch)

(Branch Address)

Sub.: Application for closure of my credit card.

Dear Sir/Madam,

I am writing to request the cancellation/closure of my credit card account. The account number is ____________ (mention credit card number).

The reasons for my request are ___________ (give reasons why you want to cancel/close credit card account). I have enclosed ___________ (enclose any relevant documents, if any) as supporting evidence.

I would appreciate it if you could process my request at the earliest and confirm receipt of this letter via ___________ ( mention method of communication, such as email or phone call). Thank you for your time and consideration.

I am enclosing a self-attested copy of my PAN card for verification purposes.

Kindly do the needful and oblige.

Thanking you,

Yours faithfully,

(Signature)

(Name of the Credit Card holder)

Conclusion

In conclusion, closing a credit card account is a decision that should be approached with careful consideration and a thorough understanding of the process. By following the step-by-step guide and utilizing the tips, you can confidently navigate the credit card close application process and ensure a smooth transition.

Remember to assess your financial situation, review the terms and conditions, and pay off any outstanding balances before initiating the closure. Contact the credit card issuer, provide the necessary information, and carefully follow their instructions to complete the process. Obtaining written confirmation of the account closure and monitoring your credit report afterward are essential steps to ensure accuracy and maintain a healthy financial standing.

At [Your Company Name], we understand the significance of empowering individuals with knowledge and providing comprehensive resources. Our goal is to assist you in making informed financial decisions and navigating the credit card close application process effectively.

If you have any further questions or need guidance during the credit card close application process, do not hesitate to reach out to our team of financial experts. We are here to support you and provide personalized assistance tailored to your specific needs.

Remember, closing a credit card account is just one aspect of managing your overall financial health. To ensure a secure and stable financial future, it is important to continue practicing responsible financial habits, such as budgeting, monitoring your credit, and making timely payments.

Thank you for choosing [Your Company Name] as your trusted resource for valuable financial information. We are dedicated to assisting you in achieving your financial goals and providing the best possible guidance to help you make informed decisions.