Letter to Bank to Change Mailing Address of Company Business

If you would like to change the address your bank has on file for your company’s business, you will need to submit a formal request to the bank along with copies of address proof for the update. Address proof can include a lease agreement, utility bill, or other official correspondence showing the new address. It is essential to keep your bank updated with your current address so that they can send important documents and communications to you promptly.

To start:

- Address the letter to the attention of your bank’s customer service department.

- In the body of the letter, state clearly that you are requesting an address change for your business account.

- Include the old address and the new address in the note.

- Sign and date the letter, and include any supporting documentation as proof of the address change.

Similar post: Request Letter to Bank to Add/ Change/ Update Mobile Number

Address Change Letter to Bank: A Comprehensive Guide with Sample Formats

Introduction:

In this digital age, where online banking has become the norm, keeping your banking information current is crucial. A critical aspect of this is notifying your bank about an address change. Failing to do so can lead to missed statements, delayed correspondence, and potential security risks. To ensure a smooth transition and maintain a hassle-free banking experience, we have prepared a comprehensive guide on how to draft an address change letter to your bank. This article will provide you with a deep understanding of the process, along with sample formats that you can use as a reference.

Section 1: The Importance of Notifying Your Bank about Address Change Before diving into the specifics of drafting an address change letter, let’s discuss why informing your bank about any changes in your residential address is crucial.

1. Seamless Communication

Keeping your bank updated with your current address ensures you receive all essential communications without any delays. This includes bank statements, transaction alerts, and other financial notifications that require your attention.

2. Prevent Misplaced Documents

By promptly notifying your bank about the address change, you can avoid the inconvenience of having essential documents, such as credit card statements or loan notices, sent to the wrong address. This helps you stay organized and prevents potential privacy breaches.

3. Protect Against Identity Theft

Maintaining accurate address information with your bank is a proactive step in safeguarding your personal and financial information. It reduces the risk of identity theft or fraudulent activities associated with outdated addresses.

Section 2: How to Draft an Address Change Letter to Your Bank Now, let’s delve into the step-by-step process of drafting an effective address change letter to help you smoothly update your information with your bank.

1. Begin with the Proper Heading and Salutation

Start your letter by including your name, current address, contact details, and date. Follow this with the bank’s name, address, and contact information. Use a formal salutation, such as “Dear [Bank Name],” to address the bank representative.

2. Clearly State Your Intent

In the opening paragraph, clearly state your purpose of writing the letter – to inform the bank about your address change. Include your account number(s) and any other relevant details to ensure accurate processing.

3. Provide Detailed Information in the Main Body

In the letter’s main body, provide the necessary details related to your address change. Consider the following points:

4. New Address

Clearly state your new residential address, including the street name, apartment number (if applicable), city, state, and ZIP code. Ensure the accuracy of the information to avoid any confusion or errors during the update process.

5. Effective Date

Specify the date your new address should be reflected in the bank’s records. It’s advisable to provide a reasonable timeframe to allow the bank sufficient time to process the update.

6. Supporting Documentation

Mention that you have enclosed or attached documents as proof of your new address. These documents may include a recent utility bill, lease agreement, or government-issued identification card displaying the updated address. Providing supporting documentation strengthens your request and speeds up the verification process.

7. Contact Information

Provide updated contact details, such as your phone number and email address. This ensures that the bank can reach out to you quickly, if needed, during the update process or for further communication.

8. Additional Instructions

: If any specific instructions or requests related to the address change, such as forwarding mail or updating joint accounts, clearly state them in this section. Be concise and straightforward to avoid any confusion.

9. Conclude with a Polite Closing and Signature

Thank the bank for their attention to your request in the closing paragraph. Use a polite closing phrase, such as “Thank you for your prompt attention to this matter.” End the letter with a formal closing, such as “Yours sincerely,” followed by your full name and signature.

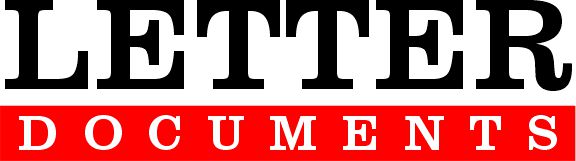

Section 3: Sample Address Change Letter Formats To better understand how to structure your address change letter, we have prepared two sample formats: one for an individual account and another for a joint statement. These formats can serve as a starting point for your letter, which you can personalize based on your circumstances.

1. Format for Individual Account

[Include a sample letter format specifically designed for updating the address of an individual bank account. Provide a step-by-step template that individuals can use as a reference while drafting their letter.]

2. Format for Joint Account

[Include a sample letter format tailored for joint account holders who wish to update their address together. Highlight the necessary information and considerations for joint account holders in this template.]

Section 4: Tips for Writing an SEO-Optimized Address Change Letter To optimize your address change letter for search engines, consider the following tips:

1. Include Relevant Keywords

Incorporate relevant keywords in your letter, such as “address change letter,” “bank address update,” or “residential address notification.” This helps search engines understand the content of your letter and improves its visibility in search results.

2. Use Clear and Concise Language

Write your letter in clear and concise language, making it easy for readers and search engines to understand the purpose and content. Avoid unnecessary jargon or complex terminology that may confuse the audience.

3. Provide Comprehensive Information

Ensure that your letter provides comprehensive information about the address change process, including the necessary details, supporting documentation, and additional instructions. This helps readers find all the information they need in one place and improves the overall user experience.

4. Structure Your Content

Use headings and subheadings to structure your letter effectively. This makes it easier for readers to navigate the content and for search engines to identify the main topics covered in your letter.

5. Proofread and Edit

Before finalizing your letter, proofread it thoroughly for any grammatical errors or typos. A well-written and error-free letter enhances its SEO potential and reflects positively on your professionalism.

Section 5: Conclusion Updating your bank with your new address is essential to ensure seamless communication and protect your financial information. By following the guidelines in this comprehensive guide and utilizing the sample formats, you can draft an effective address change letter informing your bank about the necessary updates. Remember to use clear and concise language, include all relevant details, and proofread your letter before sending it. With these steps, you can smoothly transition your banking information and enjoy a hassle-free banking experience.

Similar post: Application for Bank Manager

TEMPLATE #1

(Letter from Company)

Date: _______

To

The Branch Manager

(Name of the Bank)

(Name of the Branch)

Sub.: Change of address in our current account.

Dear Sir/Madam,

We are writing to inform you that we have changed our mailing address for our company business. Our new address is as follows:(unknown address)

We would appreciate it if you could update our address in your records and send all future correspondence to our new address. If you have any questions, please do not hesitate to contact us at (phone number). Thank you for your time and assistance.

Therefore, we kindly request you to update the address as requested above.

Thanking you,

Yours faithfully,

(Signature)

(Name of the Authorised Signatory)

(Designation)

TEMPLATE #2

(Letter from Business Shop Owner)

Date: ______

To

The Branch Manager

(Name of the Bank)

(Name of the Branch)

Sub.: Change of address in my current account.

Dear Sir/Madam,

I am writing to inform you that I have recently changed my address. As such, I would like to update my mailing address on file with the bank. My new address is as follows:(unknown address)

Please update my address in your records and send all future correspondence to this address. If you have any questions, please do not hesitate to contact me at (phone number). Thank you for your time and attention to this matter.

Thanking you,

Yours faithfully,

(Signature)

(Name of the Proprietor)

Conclusion:

Updating your address with your bank is crucial in maintaining accurate and up-to-date banking information. By following the guidelines provided in this article, you can draft an address change letter that effectively communicates your request to the bank. Be polite, provide accurate information, and include supporting documents to facilitate a prompt address update.

Notifying your bank about an address change ensures that you receive essential account-related communications promptly, prevents the inconvenience of missed or delayed mail, and helps protect your financial information from potential security risks. You demonstrate your commitment to maintaining a smooth and secure banking experience by taking the initiative to update your address.

Utilize the sample formats in this article as a starting point for crafting your address change letter. Personalize the letter according to your circumstances and include all relevant details, such as your new address, effective date, and additional instructions or requests.

Remember that a well-structured and SEO-optimized address change letter can help you communicate effectively with your bank and improve its visibility in search engine results. Incorporate relevant keywords, use clear and concise language, and ensure comprehensive information to enhance the SEO potential of your letter.

Now that you have a comprehensive understanding of how to draft an address change letter to your bank, take action and ensure that your banking information remains accurate and up to date. Stay organized, protect your privacy, and maintain a seamless banking experience by promptly notifying your bank about any changes in your residential address.