Letter to Bank for closing Fixed Deposit FD before/after Maturity

Most banks will not entertain requests for withdrawal of fixed deposit money before the maturity date. If you still request a withdrawal, you might lose a significant portion of the interest on it. The bank may even totally waive it as per its terms and conditions.

However, there can be situations when people need to close their FD account before maturity. For example, they may need the money for emergency purposes, or they might have found a better investment opportunity. In such cases, they can write a letter to the bank requesting to close their FD account.

Similar Post: Request Letter To Bank For Cash Credit Limit

Fixed Deposit Closing Letter Sample: A Comprehensive Guide

You might have invested in a fixed deposit at some point, and the time has come to close it. This article aims to provide a comprehensive guide on writing a fixed deposit closing letter. It will also provide you with sample formats that you can use to write a professional letter to your bank.

A fixed deposit is a popular investment option for people who want to earn a fixed interest rate on their money for a specific period. When the deposit matures, you can renew it or close it and withdraw the money. If you have decided to close your fixed deposit account, you must inform your bank through a formal letter.

How to Write a Fixed Deposit Closing Letter

When writing a fixed deposit closing letter, you must ensure it is professional and concise. The letter should clearly state your intention to close the account, the reason for the closure, and any other relevant information. Here is a step-by-step guide on how to write a fixed deposit closing letter:

1. Start with a proper salutation.

The letter should start with a proper salutation, such as “Dear Sir/Madam” or “To Whom It May Concern.”

2. Provide your details.

You need to provide your details, such as your full name, account number, and contact information.

3. State your intention to close the account.

In the opening paragraph, state your intention to close the fixed deposit account. You can use a sentence like “I am writing to inform you that I wish to close my fixed deposit account.”

4. Mention the reason for the closure.

In the next paragraph, you should mention the reason for the closure. This could be due to maturity, urgent financial needs, or other reasons. Be specific and concise.

5. Provide instructions for the transfer of funds.

If you want the funds to be transferred to your savings or current account, you should provide clear instructions on how the transfer should be made. You can also request a cashier’s check or a wire transfer.

6. Express gratitude.

In the final paragraph, express your gratitude to the bank for their services. You can use a sentence such as “Thank you for your excellent services throughout my fixed deposit account duration.”

7. Close with a proper closing.

The letter should end with a proper closing, such as “Sincerely” or “Yours Faithfully,” followed by your name and signature.

Similar Post: Request Letter to Bank for Cancellation/ Closing of Credit Card

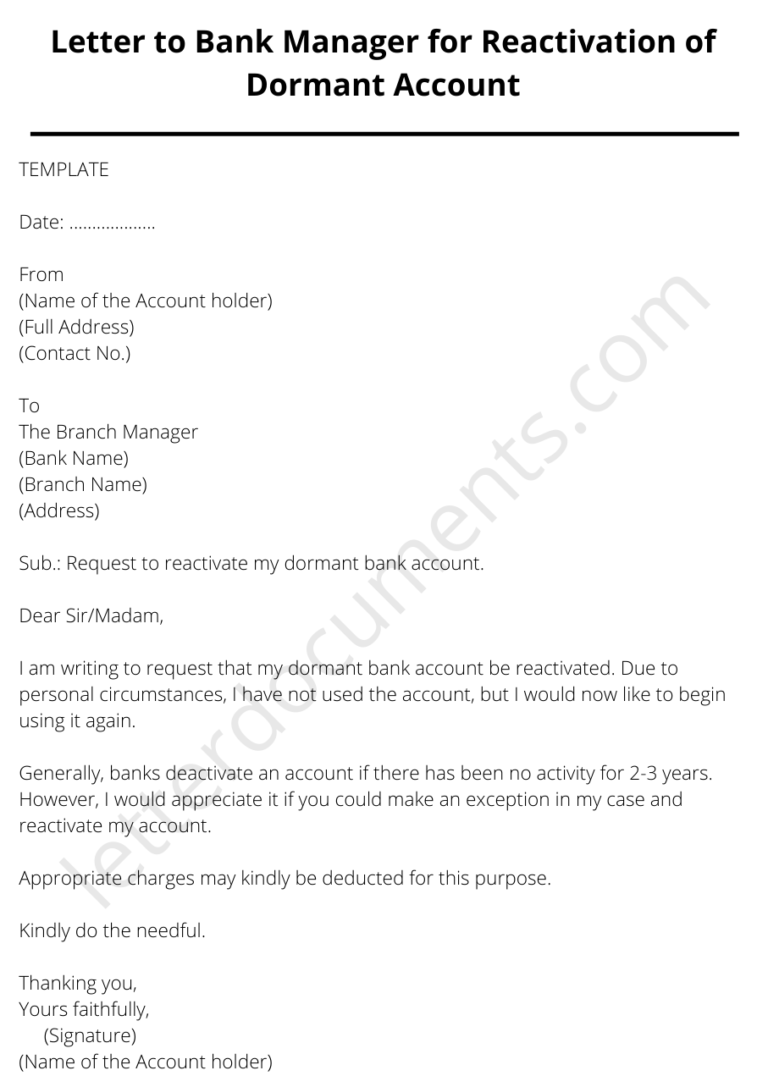

TEMPLATE

Date: ………………

From

(Name of the Account/ FD holder)

(Address)

(Phone Number)

To

The Branch Manager

(Name of the Bank)

(Name of the Branch)

(Address)

Sub.: Surrender of fixed deposit for withdrawal of money

Dear Sir/Madam,

I want to request the early withdrawal of my fixed deposit amount from the bank. The fixed deposit was made on (date) for a tenure of (xx months/years). However, due to some unforeseen circumstances, I cannot keep the fixed deposit until maturity.

I understand that there may be a penalty for withdrawing the fixed deposit before maturity. I am willing to pay the penalty fee per the bank’s rules and regulations. I have enclosed all the necessary documents required for this process.

I would appreciate it if you could process my request at the earliest. If you have any questions, please do not hesitate to contact me at (contact number).

Thanking you,

Yours faithfully,

(Signature)

(Name of the Account/ FD holder)

Enclosure:

(1) Original FD receipt

(2) PAN card signed copy

Conclusion

In conclusion, writing a high-quality fixed deposit closing letter can be crucial to maintaining good relationships with banks and financial institutions. A well-written letter can ensure that all the formalities are completed and the money is safely transferred to the designated account.

To write an effective fixed deposit closing letter, it is essential to follow a few guidelines:

- Include all relevant information about the fixed deposit, including the account number, the name of the account holder, and the amount to be withdrawn.

- Provide details about the account where the money will be transferred, such as the account number and the account holder’s name.

- Express gratitude towards the bank and financial institution for their services.

This article has helped you better understand how to write a fixed deposit closing letter. Remember, a well-crafted letter can make all the difference in ensuring a smooth transaction and maintaining good relationships with banks and financial institutions.