Loan Cancellation Letter

If you are looking to cancel a loan, you should follow these steps:

- Check the terms and conditions of the loan agreement: Before proceeding with the cancellation, review the terms and conditions of your loan agreement to ensure you know of any penalties, fees, or other requirements associated with the cancellation.

- Contact the lender: Contact your lender and inform them that you wish to cancel the loan. Please provide them with your loan account number and any other relevant information.

- Explain the reason for cancellation: Be honest and explain why the loan is cancelled. If it’s due to financial difficulties, inform them of your current financial situation and why you cannot continue with the loan.

- Follow lender’s instructions: The lender may require you to fill out a cancellation request form or provide additional documentation. Follow their instructions carefully and provide all the required information.

- Confirm the cancellation: After completing all the necessary steps, confirm with the lender that the loan has been cancelled. Obtain written confirmation if possible.

- Check credit report: Once the loan has been cancelled, check your credit report to ensure that the cancellation has been reported correctly and that there are no errors.

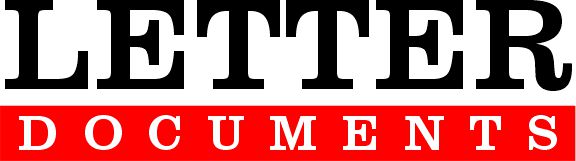

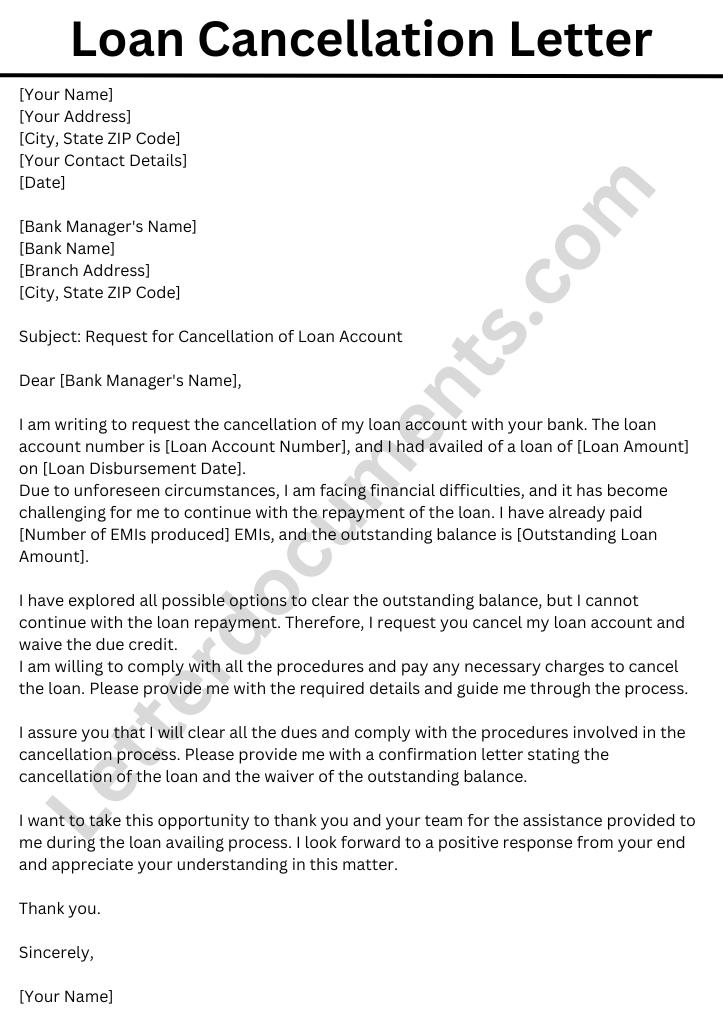

Here’s an example of a loan cancellation letter:

TEMPLATE #1 (Letter)

[Your Name]

[Your Address]

[City, State ZIP Code]

[Your Contact Details]

[Date]

[Bank Manager’s Name]

[Bank Name]

[Branch Address]

[City, State ZIP Code]

Subject: Request for Cancellation of Loan Account

Dear [Bank Manager’s Name],

I am writing to request the cancellation of my loan account with your bank. The loan account number is [Loan Account Number], and I had availed of a loan of [Loan Amount] on [Loan Disbursement Date].

Due to unforeseen circumstances, I am facing financial difficulties, and it has become challenging for me to continue with the repayment of the loan. I have already paid [Number of EMIs produced] EMIs, and the outstanding balance is [Outstanding Loan Amount].

I have explored all possible options to clear the outstanding balance, but I cannot continue with the loan repayment. Therefore, I request you cancel my loan account and waive the due credit.

I am willing to comply with all the procedures and pay any necessary charges to cancel the loan. Please provide me with the required details and guide me through the process.

I assure you that I will clear all the dues and comply with the procedures involved in the cancellation process. Please provide me with a confirmation letter stating the cancellation of the loan and the waiver of the outstanding balance.

I want to take this opportunity to thank you and your team for the assistance provided to me during the loan availing process. I look forward to a positive response from your end and appreciate your understanding in this matter.

Thank you.

Sincerely,

[Your Name]

TEMPLATE #2 (Letter)

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Bank Manager’s Name]

[Bank Name]

[Bank Address]

[City, State ZIP Code]

Subject: Cancellation of Loan Request

Dear Sir/Madam,

I am writing to request the cancellation of the loan I applied for on [date]. My loan application number is [insert your loan application number].

Due to unforeseen circumstances, I have decided to cancel my loan request. Please

let me know how to balance my loan application and any further steps I need to take.

Thank you for considering my loan application and for your time and assistance.Please let me know if further documentation is required to complete this process. I am available to provide any additional information that may be necessary.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]