Sample Letter to Bank for Prepayment or Foreclosure of Loan

If you are considering prepaying or foreclosing your loan, you will need to write a bank for prepayment or foreclosure of loan letter. This letter is necessary because it gives the bank notice of your intentions and allows them to object to the prepayment or foreclosure.

When writing a bank for prepayment or foreclosure of loan letter, there are a few things that you should keep in mind:

- You will need to include your contact information and account number.

- You must state your intent to prepaid or foreclose on the loan.

- You will need to provide a reason for your decision.

Similar Post: Loan Cancellation Letter

Loan Foreclosure Letter: What You Need to Know and How to Write One

Receiving a loan foreclosure letter can be overwhelming and stressful for a borrower. A loan foreclosure letter is a legal document sent by a lender to a borrower to notify them that their loan is in default and that foreclosure proceedings will begin if the borrower does not take appropriate action to bring their account current. This article will discuss everything you need to know about loan foreclosure letters, including what they are, why they are essential, and how to write one.

What is a Loan Foreclosure Letter?

A loan foreclosure letter is a document a lender sends to a borrower when the borrower has defaulted on their loan payments. The letter will typically outline the terms of the loan, the amount of the payments that have been missed, and the amount of money that is required to bring the loan current. The letter will also inform the borrower that foreclosure proceedings will begin if they do not take appropriate action.

Why is a Loan Foreclosure Letter Important?

A loan foreclosure letter is essential for both lenders and borrowers. For lenders, the letter is a necessary legal document that informs the borrower of the consequences of defaulting on their loan payments. For borrowers, the letter serves as a warning that foreclosure proceedings will begin if they do not take appropriate action to bring their account current.

How to Write a Loan Foreclosure Letter

If you are a lender and need to write a loan foreclosure letter, there are specific steps to ensure that your letter is clear, concise, and practical. Here are the steps you should take when writing a loan foreclosure letter:

Step 1: Identify the Borrower

The first step in writing a loan foreclosure letter is identifying the borrower. You should include the borrower’s name, address, and any other necessary identifying information to ensure that the letter is delivered to the correct person.

Step 2: Explain the Situation

Once you have identified the borrower, the next step is to explain the situation. You should outline the terms of the loan, the amount of the payments that have been missed, and the amount of money that is required to bring the loan current. Be sure to include any relevant dates, such as the date of the first missed payment and the date of the most recent payment.

Step 3: Inform the Borrower of Consequences

In your loan foreclosure letter, you should inform the borrower of the consequences of defaulting on their loan payments. Let them know that foreclosure proceedings will begin if they do not take appropriate action.

Step 4: Provide Options

It is essential to provide the borrower with options for bringing their account current. This could include payment plans or other arrangements allowing the borrower to catch up on their payments.

Step 5: Explain the Foreclosure Process

In your loan foreclosure letter, you should also explain the foreclosure process. Let the borrower know what will happen if they do not take appropriate action and how long they must respond to the letter.

Step 6: Provide Contact Information

Finally, be sure to provide the borrower with contact information for your organization. This will allow them to contact you with any questions or concerns.

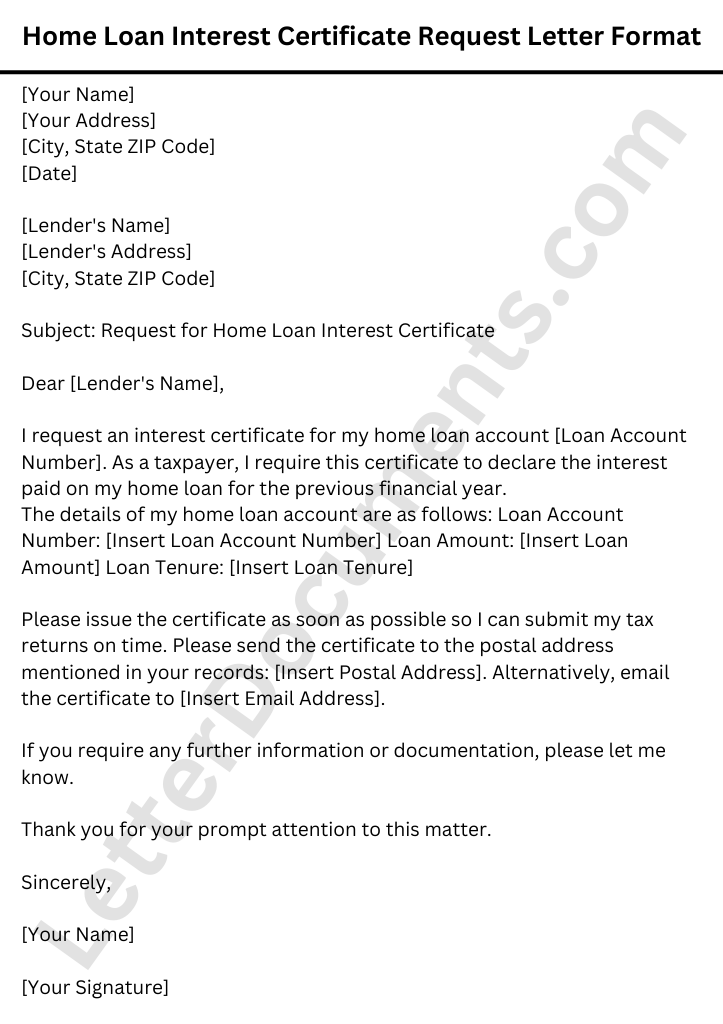

Similar Post: Home Loan Interest Certificate Request Letter Format

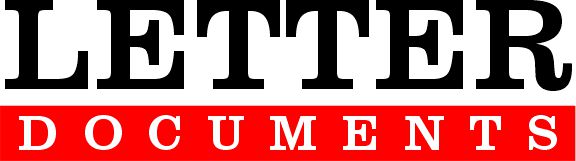

TEMPLATE

Date: ________

From

(Name of the Borrower)

(Address)

Mob. _________

Email: ___________

To

The Branch Manager

(Name of the Bank)

(Name of the Branch)

(Bank Address)

Sub.: Request for prepayment / pre-closure of loan obtained

Ref: Loan account number ___________

Dear Sir/Madam,

I am writing this letter to inform you that I would like to request for prepayment / pre-closure of my loan amounting to $____________ (loan amount). I have been a good-paying customer of the bank, and I can fully settle my loan earlier than the maturity date.

The loan’s prepayment / pre-closure will enable me to save on interest payments. I am attaching all the necessary documents for your perusal. I hope that you will approve my request at the soonest possible time. Thank you very much.

I confirm that the prepayment/ pre-closure payment is being made from the sources mentioned herewith. Please note the following details of payment enclosed towards prepayment / pre-closure of the said loan:

1. Cheque/ DD/ Ref. No. ________ dated _________.

2. Amount: __________.

3. Bank name and Branch: _____________.

4. Bank account number: ___________.

5. Payer name: _______________________.

6. Source Description with Source Amount Breakup.

7. Details of Bank Statement/ Other Document evidencing source: ___________.

The bank statement for the last six months is enclosed herewith for your kind information.

(Write this para only for pre-closure.) Further, if any excess amount is available under my loan account after adjusting all the dues and charges, then you are kindly requested to remit such amount directly to my following bank account: (a) Bank name: _____________, (b) Account number: __________, (c) Type: Savings/Current, (d) IFSC: __________, (e) MICR: _________, and (f) Account-holder name: __________.

Kindly do the needful and oblige.

Thanking you,

Yours faithfully,

(Signature)

(Name of the Borrower)

Conclusion

In conclusion, a loan foreclosure letter is a legal document that notifies a borrower that they have defaulted on their loan and the lender is starting the foreclosure process. It is a serious matter and should be handled promptly and professionally. In order to avoid foreclosure, it is important for borrowers to communicate with their lenders and explore alternative options such as loan modifications, refinancing, or selling the property.

If you receive a loan foreclosure letter, it is important to seek legal advice and take appropriate actions to protect your interests. While it can be a daunting and stressful experience, there are resources available to help borrowers navigate through the foreclosure process.

In terms of SEO, creating high-quality content that provides value to readers and incorporates relevant keywords and subheadings is key to outranking other websites. By providing comprehensive information on loan foreclosure letters, we hope to not only improve our search engine rankings but also assist readers in understanding the foreclosure process and how to take appropriate actions.