Request Letter format to Bank Manager for One Time Settlement

If you are looking to write a bank manager for a one-time settlement, there are a few things that you will need to keep in mind. First, it is essential to remember that this letter should be formal and professional. You will want to ensurRequest Letter format to Bank Manager for One Time Settlemente that you use proper grammar and punctuation throughout the letter. Additionally, you will want to state your case clearly and concisely. Here are a few tips to help you write a bank manager one-time settlement letter.

When writing the letter, you will want to start by introducing yourself and stating the purpose of your letter. Next, you will want to provide background information on your current financial situation. Be sure to include any relevant information, such as why you are behind on your payments and what steps you have taken to try and remedy the situation.

After you have provided background information, you will want to state your request for a one-time settlement. Be sure to be clear about the amount you are requesting and how you would like it to be paid out. You will also want to explain why you believe a one-time settlement is the best option for both parties involved.

One Time Settlement Letter Format: A Comprehensive Guide

In financial transactions and debt management, the one-time settlement letter is a crucial document that holds significance for both creditors and debtors. This letter is a formal agreement between the creditor and the debtor, outlining the terms and conditions for settling a debt in a single payment. In this comprehensive guide, we provide an in-depth understanding of the one-time settlement letter format and its importance and offer sample formats to facilitate the settlement process.

Benefits of a One-Time Settlement Letter

A one-time settlement letter offers several advantages for both parties involved. For debtors, it provides an opportunity to alleviate the burden of a prolonged debt, avoiding the complexities and uncertainties of extended payment plans. It enables debtors to manage their finances better and regain control over their economic situation. On the other hand, creditors benefit from a one-time settlement by expediting the recovery process, minimizing administrative costs, and reducing the risk of non-payment or default.

Components of a One-Time Settlement Letter

To ensure the effectiveness and validity of a one-time settlement letter, it is crucial to include the following key components:

1. Introduction and Purpose

Clearly state the letter’s purpose, proposing a one-time settlement for the outstanding debt. Include relevant details such as the creditor’s name, the debtor’s name, account number, and any other necessary identification information.

2. Debt Details

Provide a comprehensive overview of the debt, including the total amount owed, the date of origination, and any interest or late payment charges accrued. It is essential to present this information accurately to avoid any disputes or confusion during the settlement process.

3. Settlement Offer

Clearly articulate the proposed settlement amount, typically lower than the total outstanding debt. State the reasons for the proposed reduction, such as financial hardship or the willingness of the debtor to resolve the matter promptly. Accepting the settlement offer will be considered as full and final satisfaction of the debt.

4. Payment Terms

Specify the payment terms, including the due date and acceptable modes of payment. It is essential to outline the available options, such as online transfer, cashier’s check, or money order, to provide convenience for both parties.

5. Release of Liability

Include a clause that states the debtor’s release from any further liability upon successfully settling the agreed-upon amount. This clause ensures the debtor is no longer legally obligated to pay the remaining balance.

6. Acceptance and Signature

Allocate space for the debtor’s signature, date, and printed name to signify their agreement to the terms and conditions outlined in the settlement letter. Similarly, provide a designated area for the creditor’s authorized representative to sign, acknowledging acceptance of the settlement offer.

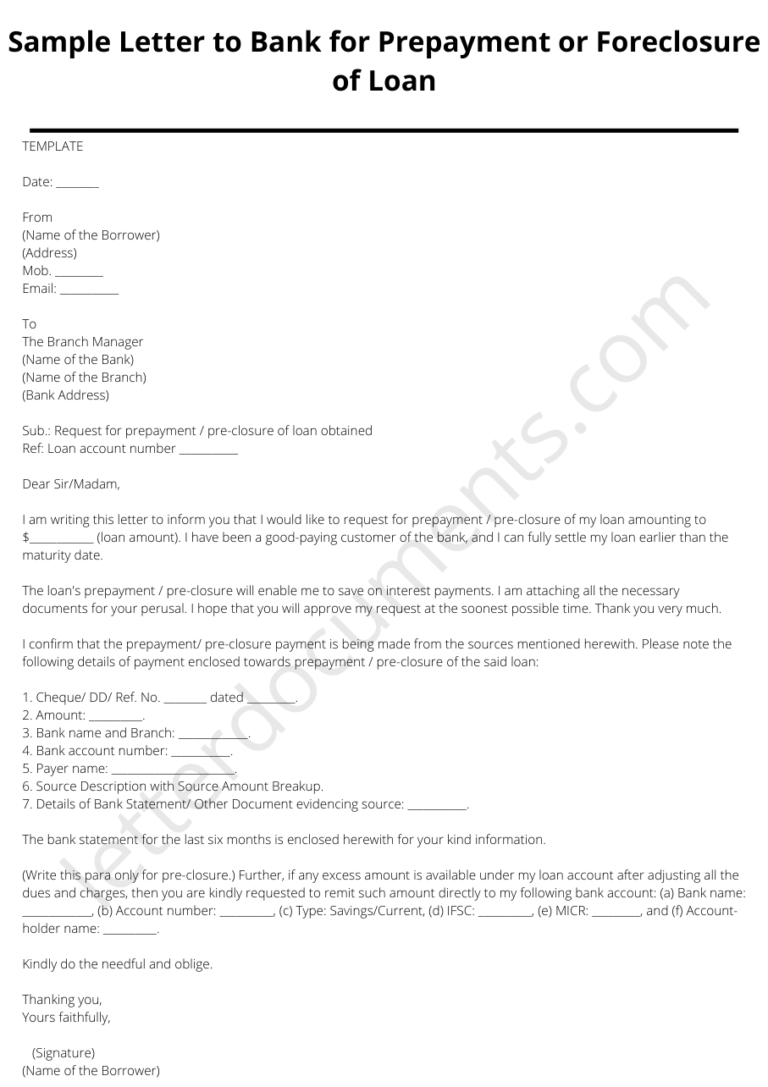

TEMPLATE

Date: __________

From

(Name of the Loan Account-holder)

(Registered Address)

(Telephone Number)

To

The Branch Manager

(Name of the Bank)

(Name of the Branch)

(Address)

Sub.: Request for a One-Time Settlement of the Loan

Dear Sir/Madam,

I am writing this letter to request a one-time settlement of my loan amounting to $5,000. I have struggled to make regular monthly payments due to personal financial difficulties. I have tried my best to keep up with the payments, but it has become impossible for me to do so anymore.

I am confident that I will be able to make a lump sum payment of the entire outstanding amount if you give me some time. I would be highly grateful if you could consider my request and help me in this challenging situation.

I hope your good self will appreciate my financial situation and consider my proposal favorably. I kindly request you to settle the issue for the amount suggested by me, please.

Thanking you,

Yours faithfully,

(Signature)

(Name of the Loan Account-holder)

Conclusion

In conclusion, the one-time settlement letter format facilitates debt resolution between creditors and debtors. By understanding the key components and including them in a well-structured letter, both parties can benefit from a swift and amicable settlement process. The sample format provided in this guide is a valuable resource for crafting your one-time settlement letter. Utilizing this comprehensive guide and creating high-quality content can enhance your chances of outranking other websites on Google’s search results. Remember, an optimized one-time settlement letter helps resolve debts and showcases your professionalism and commitment to fair and transparent financial practices.