Death Claim Letter Format For Bank

Writing a death claim letter to a bank can be a sensitive matter, but it’s essential to do so to notify the bank of the account holder’s passing and initiate the process of settling the account. Here are the steps to follow when writing a death claim letter for a bank:

- Address the letter to the bank’s customer service department or the department responsible for handling death claims.

- Provide the bank with the account holder’s full name, account number, and Date of death. You may also need to include a copy of the death certificate or other proof of death.

- Explain your relationship to the deceased and whether you are the executor of their estate or have been appointed as their legal representative.

- Request that the bank freezes the account and provide you with information about the process for settling the bill, including any required documentation or forms.

- Provide your contact information so the bank can contact you with further questions or updates.

Death Claim Letter Format for Bank: A Comprehensive Guide

When a loved one dies, dealing with the necessary paperwork can be overwhelming. One crucial task is filing a death claim with the bank to ensure a smooth transition of the deceased’s assets. In this article, we will provide you with a comprehensive guide on a bank’s death claim letter format. We understand the importance of this process and aim to assist you in navigating through it seamlessly.

Importance of the Death Claim Letter

The death claim letter formally requests the bank to release the deceased person’s assets to the designated beneficiaries or heirs. This letter is an essential document that initiates settling financial matters after a person’s demise. Submitting a well-structured and professionally written death claim letter is crucial for a prompt and accurate response from the bank.

H2: Understanding the Importance of Death Claim Letters

H3: What is a Death Claim Letter?

A death claim letter is a formal document submitted to a bank or financial institution to notify them about the demise of an account holder. It serves as a request for the release of funds, settlement of outstanding dues, or transfer of assets to the designated beneficiaries or legal heirs. This letter is a crucial communication tool between the concerned parties, ensuring a smooth and efficient process in such sensitive matters.

H3: Significance of a Well-Structured Death Claim Letter

Writing a death claim letter clearly, concisely, and professionally holds immense importance. It helps facilitate the settlement of financial matters and ensures that the bank or financial institution processes the claims efficiently. A well-structured letter not only expedites the process but also portrays the seriousness and professionalism of the sender. Moreover, a properly formatted death claim letter demonstrates respect for the deceased and their financial affairs, contributing to a smooth transition for the beneficiaries or legal heirs.

H2: Essential Elements of a Death Claim Letter

H3: Contact Information and Date

Begin the letter by providing your contact information, including your full name, address, phone number, and email address, aligned to the left side of the page. Follow this with the current date in a standardized format, ensuring clarity and professionalism.

H3: Bank Details and Address

Next, provide the details of the bank or financial institution, including the bank’s name, branch address, and contact information. This information helps the recipient identify the account and initiate the necessary procedures promptly.

H3: Salutation

Address the letter to the appropriate authority at the bank. A general salutation such as “To Whom It May Concern” will suffice if you are unsure about the exact recipient. However, addressing the letter to a specific individual whenever possible is always advisable.

H3: Subject Line

Write a concise and descriptive subject line that indicates the letter’s purpose. For example, “Subject: Death Claim Request for [Account Holder’s Full Name].”

H3: Introduction and Relationship to the Deceased

In the opening paragraph, introduce yourself and your relationship to the deceased account holder. Mention your name, contact information, and connection with the dead, highlighting your eligibility to act as the claimant or representative.

H3: Provide Account Information

In the subsequent paragraph, furnish the necessary details about the account held by the deceased. Include the account number, account type, and other relevant information that helps the bank identify and locate the report without confusion.

H3: Notification of Death and Required Documents

In this section, formally notify the bank of the account holder’s demise. Provide accurate information about the date of death, place of death, and cause of death, if available. Additionally, mention the documents required to process the claim, such as the death certificate, identification proof, and any legal documents supporting your claim as the beneficiary or legal heir.

H3: Request for Settlement and Funds Release

Clearly state your request to settle outstanding dues, release of funds, or transfer of assets held by the deceased. Specify the desired mode of payment or transfer, such as a bank transfer, check issuance, or any other applicable method.

H3: Expression of Gratitude and Contact Information

Express gratitude to the bank or financial institution for their prompt attention and cooperation. End the letter by providing your contact information once again, along with a request to contact you for any further information or clarification.

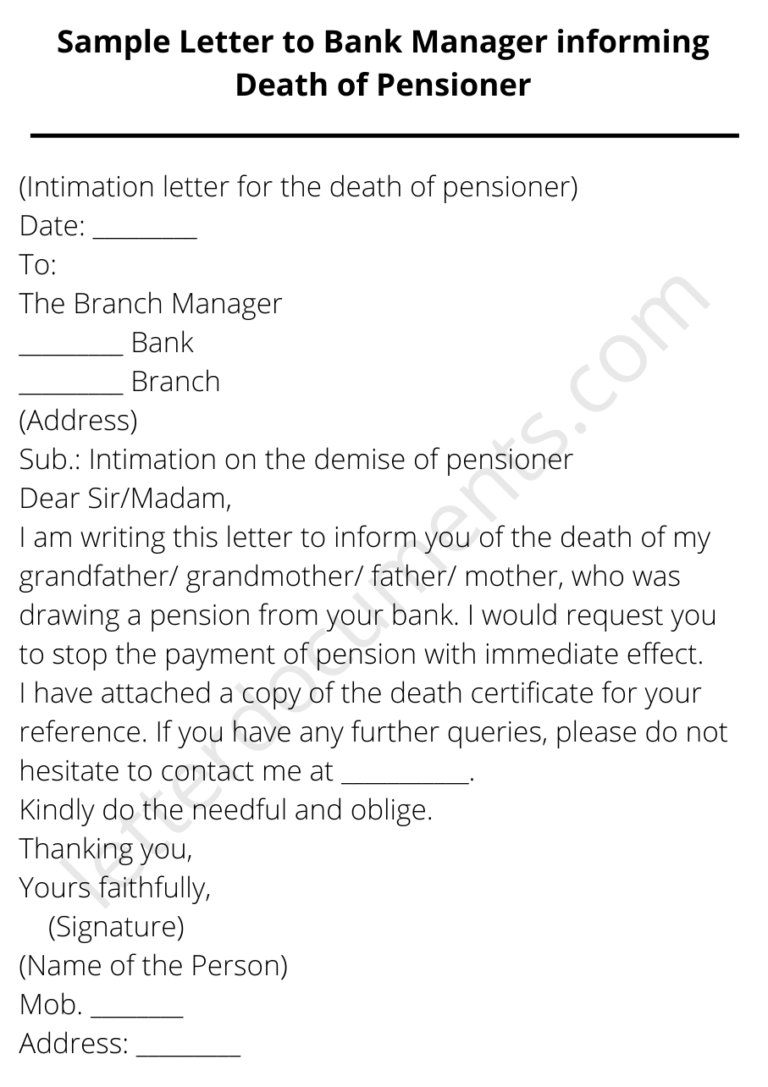

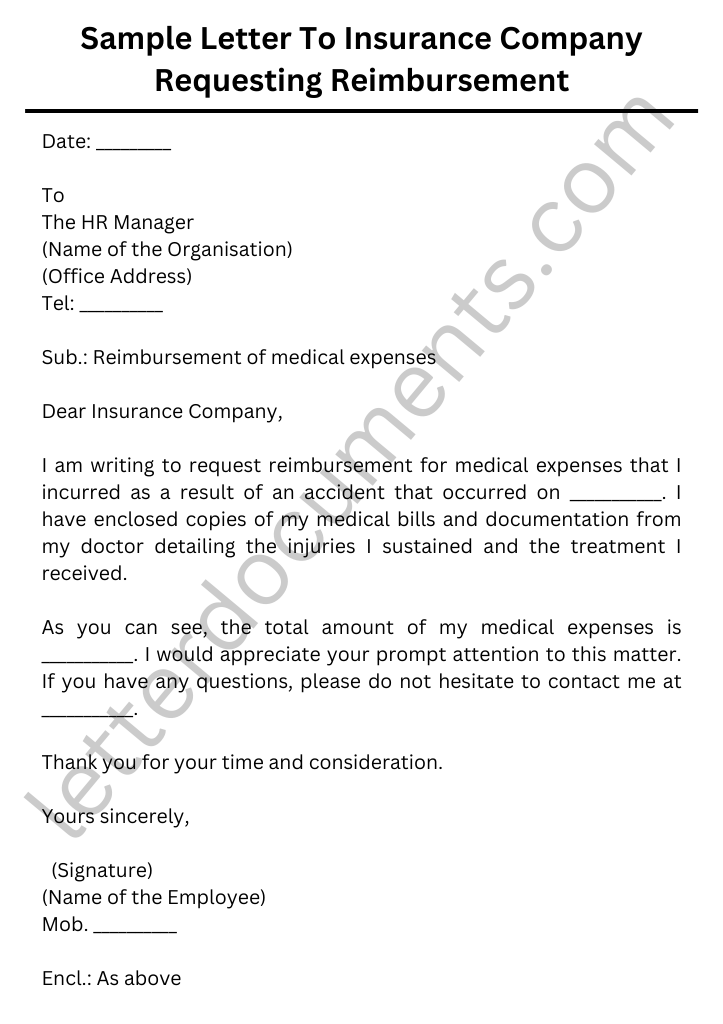

Here’s a sample death claim letter that you can use as a template:

TEMPLATE

[Your Name]

[Your Address]

[City, State ZIP Code]

[Your Phone Number]

[Your Email Address]

[Date]

[Bank Name]

[Bank Address]

[City, State ZIP Code]t

Dear Sir/Madam,

I am writing to inform you of the passing of [Account Holder’s Full Name], who held an account with your bank. [They] passed away on [Date of Death], and I am writing to request that the report be frozen and settled according to the bank’s policies.

I am the [Executor/Legal Representative/Family Member] of the deceased and responsible for handling [their] affairs. The account number is [Account Number], and [they] held [type of account] account with your bank.

Please provide information on settling the account, including any required documentation or forms. Please contact me at [Your Phone Number] or [Your Email Address] to discuss this matter further.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

Conclusion

In conclusion, the death claim letter format for a bank plays a crucial role in initiating the process of settling financial matters after the demise of a loved one. Following the comprehensive guide and utilizing the provided sample format ensures that your death claim letter is well-structured and professional.

Remember to include all necessary details and supporting documents, maintain a polite and respectful tone, and follow the bank’s specific guidelines. Keeping copies of all submitted documents and maintaining a record of correspondence will also help streamline the process.

Dealing with losing a loved one is undoubtedly challenging, and navigating the financial aspects can add to the burden. By submitting a well-crafted death claim letter, you can expedite the process and ensure a smooth transition of the deceased’s assets.

If you have any further questions or require assistance, do not hesitate to contact the bank’s customer service or seek professional guidance.