Loan Clearance Certificate from Company to Employee Format

The company has a policy that all loans must be cleared before an employee can leave the organization. This is to ensure that the employee has no outstanding debts that need to be repaid. The company will usually give the employee a grace period of two weeks to clear the loan, after which the employee will be required to repay the total amount. If the employee cannot clear the loan within this time frame, they may be subject to disciplinary action, up to and including termination of employment.

Loan Clearance Certificate: An Essential Document for Financial Transactions

In today’s fast-paced world, where financial transactions are an integral part of our lives, it is crucial to ensure transparency and authenticity. One such document that holds immense significance in finance is the Loan Clearance Certificate. This comprehensive guide highlights the importance of a Loan Clearance Certificate, its purpose, and how it can facilitate smooth financial transactions.

Understanding the Loan Clearance Certificate

A Loan Clearance Certificate is an official document issued by a lending institution or bank to borrowers upon the successful repayment of a loan. It proves the borrower has fulfilled all their financial obligations, including the principal loan amount, interest, and associated fees. This certificate signifies the closure of the loan account, ensuring a clean slate for the borrower.

Importance of a Loan Clearance Certificate

1. Establishing Financial Credibility

A Loan Clearance Certificate is pivotal in establishing an individual or a business entity’s financial credibility. It serves as concrete evidence of responsible economic behaviour and timely loan repayments. Lenders, credit agencies, and other financial institutions consider this certificate a reliable indicator of an individual or organization’s creditworthiness.

2. Facilitating Future Borrowings

Having a Loan Clearance Certificate can significantly enhance your chances of securing favourable terms and interest rates when applying for future loans, whether for personal or business purposes. Lenders view borrowers with a clear loan history as low-risk candidates, making them more likely to extend credit with attractive terms.

3. Ensuring Legal Compliance

Financial transactions involve legal obligations, and a Loan Clearance Certificate ensures compliance with all legal requirements. By obtaining this certificate, borrowers can demonstrate their adherence to financial regulations and provide documentary evidence if required by legal authorities.

Obtaining a Loan Clearance Certificate

The process of obtaining a Loan Clearance Certificate typically involves the following steps:

1. Loan Repayment

To initiate the loan clearance process, borrowers must ensure they have repaid the entire loan amount and any outstanding interest, penalties, or charges. It is essential to meticulously review the loan agreement to ascertain the exact repayment terms and conditions.

2. Contacting the Lending Institution

Once the loan has been fully repaid, borrowers should contact the lending institution or bank from which the loan was availed. They should express their intention to obtain a Loan Clearance Certificate and inquire about the required procedures and documentation.

3. Document Submission

To complete the loan clearance process, borrowers must typically submit certain documents to the lending institution. These may include identification proof, loan agreement copies, repayment statements, and any other documents stipulated by the institution.

4. Verification and Issuance

Upon receiving the necessary documentation, the lending institution will initiate the verification process to ensure that all loan-related obligations have been fulfilled. Once the verification is complete, they will issue the Loan Clearance Certificate to the borrower, officially closing the loan account.

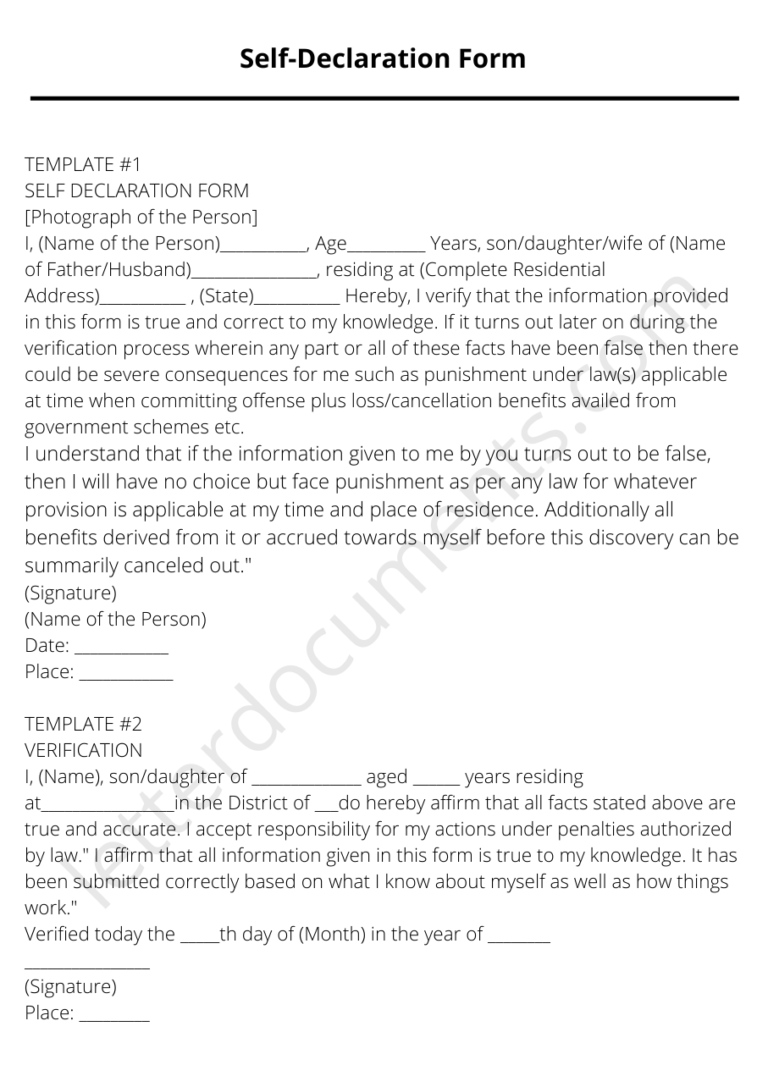

TEMPLATE #1

(Application letter from the employee for the issue of a loan clearance certificate from the employer)

Date: _________

To

(Name of the Officer)

(Designation)

(Name of the Company)

(Office Address)

Sub.: Request for issue of loan clearance certificate

Dear Sir/Madam,

I am writing to request a loan clearance certificate from my employer. I have been employed with this company for the past two years and have been regular in my repayments. However, due to unforeseen circumstances, I have fallen behind on my repayments and would like to request a loan clearance certificate.

I understand that this request needs to be made in writing, and I am willing to provide any additional documentation or information that may be required. I appreciate your time and consideration in this matter.

Thanking you,

Yours faithfully,

(Signature)

(Name of the Employee)

TEMPLATE #2

(Loan clearance certificate from employer)

To Whomsoever It May Concern,

I hope this message finds you well. I am writing to request a loan clearance certificate from my employer.

As you may know, I am applying for a mortgage, and one of the requirements is to provide a loan clearance certificate. I have been employed with your company for over three years now, and I believe I am in good standing.

I would appreciate it if you could provide me with the certificate at your earliest convenience. If you have any questions, please do not hesitate to contact me. Thank you very much for your time and consideration.

This certificate is issued to them on/her request for submission to (Name of the Organisation).

Sincerely,

(Signature)

(Name of the Officer)

(Designation)

Dated _______

Place: ________

Conclusion

A Loan Clearance Certificate holds immense importance in the realm of financial transactions. It provides concrete evidence of responsible economic behaviour, establishes financial credibility, and ensures compliance with legal requirements. By obtaining a Loan Clearance Certificate, borrowers can enhance their chances of securing future loans with favourable terms and interest rates.

To obtain a Loan Clearance Certificate, borrowers must ensure complete loan repayment and then contact the lending institution to initiate the clearance process. By submitting the required documentation and undergoing the verification process, borrowers can obtain the certificate, signifying the closure of the loan account.

In conclusion, a Loan Clearance Certificate is a vital document that signifies the successful repayment of a loan and paves the way for smooth financial transactions in the future. By understanding its significance and following the necessary procedures, borrowers can position themselves favourably in the eyes of lenders and ensure a solid financial standing.